Advancements in Electric Vehicle Technology

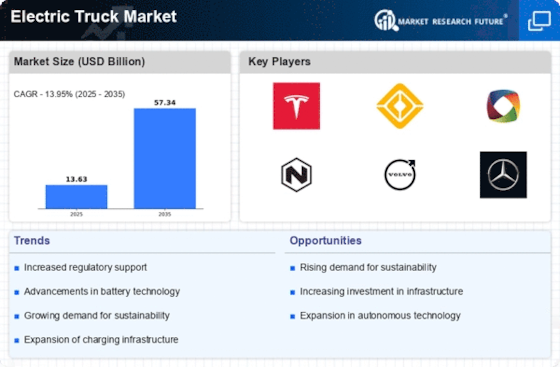

Technological innovations are playing a pivotal role in shaping the Electric Truck Market. Recent advancements in battery technology, such as solid-state batteries, are enhancing the efficiency and range of electric trucks. These developments are crucial, as they address previous limitations associated with electric vehicles, such as range anxiety and charging times. The introduction of more efficient electric drivetrains is also contributing to improved performance metrics. As a result, the market is witnessing a shift in consumer perception, with electric trucks becoming increasingly viable alternatives to traditional diesel trucks. This technological evolution is expected to catalyze growth in the Electric Truck Market, as manufacturers strive to meet the evolving needs of fleet operators and logistics companies.

Increasing Fuel Prices and Operational Costs

The Electric Truck Market is being significantly influenced by the rising fuel prices and operational costs associated with traditional diesel trucks. As fuel prices continue to fluctuate, businesses are seeking cost-effective alternatives to mitigate expenses. Electric trucks offer lower operational costs, primarily due to reduced fuel expenses and maintenance requirements. Studies indicate that electric trucks can save fleet operators up to 30% in fuel costs compared to their diesel counterparts. This economic advantage is prompting more companies to consider electric trucks as a viable option for their logistics and transportation needs. Consequently, the Electric Truck Market is likely to see accelerated adoption as businesses prioritize cost efficiency in their operations.

Rising Demand for Sustainable Transportation

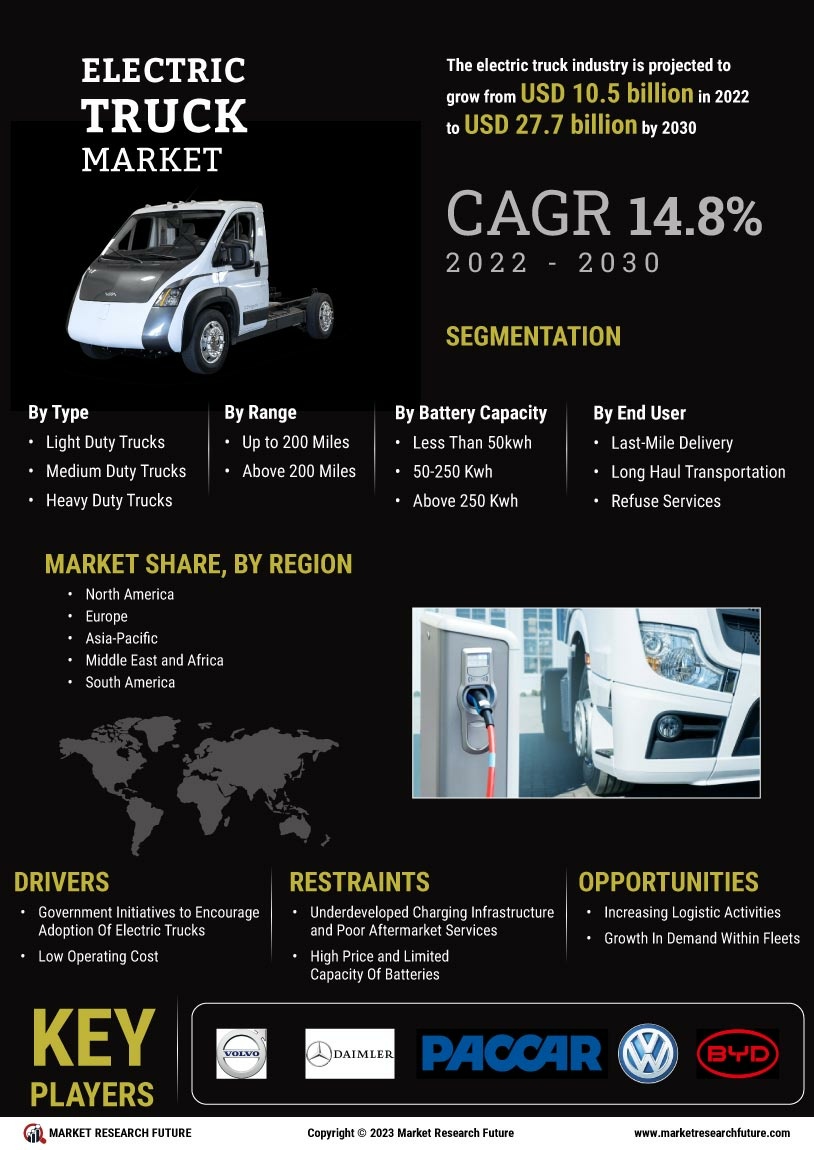

The Electric Truck Market is experiencing a notable surge in demand for sustainable transportation solutions. As environmental concerns intensify, businesses are increasingly seeking to reduce their carbon footprints. This shift is evidenced by a projected increase in electric truck sales, which is expected to reach 1.2 million units by 2030. Companies are recognizing that adopting electric trucks not only aligns with corporate social responsibility goals but also enhances their brand image. Furthermore, the transition to electric trucks is seen as a strategic move to meet the expectations of environmentally conscious consumers. This growing demand is likely to drive innovation and investment within the Electric Truck Market, fostering a competitive landscape that prioritizes sustainability.

Government Policies and Environmental Regulations

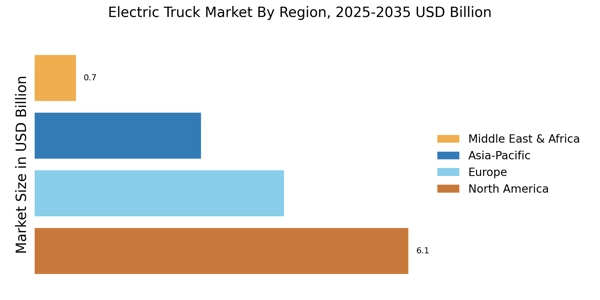

The Electric Truck Market is being shaped by stringent government policies and environmental regulations aimed at reducing greenhouse gas emissions. Many countries are implementing regulations that encourage the adoption of electric vehicles, including electric trucks. For instance, some regions are offering tax incentives and rebates for businesses that invest in electric trucks, thereby lowering the initial purchase costs. Additionally, regulations mandating emissions reductions are pushing companies to transition away from fossil fuel-powered vehicles. This regulatory environment is fostering a favorable landscape for the Electric Truck Market, as it incentivizes manufacturers and fleet operators to invest in electric truck technology and infrastructure.

Growth of E-commerce and Last-Mile Delivery Services

The Electric Truck Market is witnessing growth driven by the expansion of e-commerce and last-mile delivery services. As online shopping continues to gain traction, logistics companies are under pressure to enhance their delivery capabilities. Electric trucks are emerging as a preferred solution for last-mile delivery due to their lower emissions and operational costs. The demand for efficient and sustainable delivery options is prompting logistics providers to invest in electric truck fleets. Reports suggest that the last-mile delivery segment is expected to grow at a compound annual growth rate of 15% over the next five years. This trend is likely to bolster the Electric Truck Market, as more companies recognize the benefits of integrating electric trucks into their delivery operations.